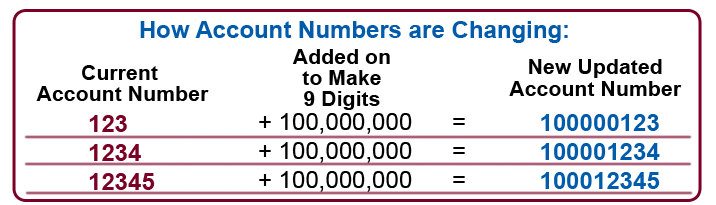

A: Yes, on October 1st Penobscot County members will be going to a nine-digit account number format. Your account number will automatically change by adding a one (1) and the quantity of zeros (0) needed to bring it to the new nine-digit format. For example, if your current account number is 123, your new account number will be 100000123. As another example, if your account number is 12345, then your new account will be 100012345.

Please begin using your updated account number format on October 1, 2021.

If your account number begins with 900 (nine zero zero), then your account number will not change. If you are an Online Banking user, please keep this new account number formatting in mind when you re-register for Online or Mobile Banking.

A: No, we will continue to clear items through both the Penobscot County FCU routing and transit number 211288158 and The County FCU routing and transit number 211288006 for the foreseeable future. However, after October 1, 2021, if you set up any new direct deposits or automatic withdrawals, please use The County FCU routing and transit number of 211288006.

No, you will not need to order new checks. Your Penobscot FCU checks will work just fine. Your checks will be updated with our new logo on your next order.

No, you can continue using your debit without any changes.

Yes, you will be able to perform ATM withdrawals and make purchases with your current Debit Card during the conversion process up to the offline limits. The Offline Daily Limits are:

• Debit Cards ($100 per day maximum ATM

withdrawal limit)

• Debit Cards ($500 per day maximum limit for

point-of-sale transactions for Checking Account)

• Debit Cards ($100 per day maximum limit for

point-of-sale transactions for Savings Account)

However, you will not be able to do balance inquiries or balance transfers at any ATM beginning at 6:00 p.m. on Wednesday, September 29, 2021 until 8:00 a.m. on Friday, October 1, 2021. You will see a message “Transaction Currently Unavailable” should you try and perform a balance inquiry or transfer during the upgrade. Deposits made at an ATM on Wednesday, September 29, 2021 will post to your account on October 1, 2021.

A: We are getting close to having our data systems merged. On September 29th at 6:00 pm we will close the Howland, Old Town, and Bangor branches, migrate our two data systems together, and open with one core data processing system a day or so later on October 1, 2021, at 8:00 am. Much more information on what is changing and more importantly what is not changing will be coming to you soon. Until then members may utilize the Shared Branching network to conduct transactions between Penobscot’s Branches and The County’s Branches. The network allows for most of your transactions including Deposits, Withdrawals, Transfers, Balance Inquiries, and Statement Printouts to name a few. Both credit unions are also members of the SURF Alliance network, which offers surcharge-free ATMs at over 260 ATMs in Maine.

A: Absolutely, member’s savings in the combined credit union is federally insured by the National Credit Union Administration (NCUA) for a total of $250,000 and backed by the full faith and credit of the United States Government.

Until CFCU and PCFCU accounts are converted to a common platform none of your accounts will change. Whether or not they will change after that depends on the type of account and the effect of the combining of operational procedures. Of course, you will be notified well in advance of any changes which may affect you.

Some commonly occurring questions:

Will my online and mobile banking change?

A: Nothing will change until September 29th. During the transition period, you will continue to use the same login credentials to access online and mobile banking. You will be notified well in advance of any changes that might affect you.

Will my debit card still work?

A: Yes.

Will my PCFCU Credit card still work?

A: Yes.

What about my recurring transactions?

A: Direct Deposits, ACH, payments, checks, and recurring debit card transactions will continue to work as they do now. You will be notified in advance of changes that may affect you if any.

Loans

-Your existing loan contract will remain in effect until the loan is paid in full.

Share Certificates

-The terms of your existing share certificate will remain in effect until the maturity date.

How are member’s accounts and printed checks impacted?

A: Members of both credit unions will experience little impact on their accounts, the checks they use, or account numbers. We would work to ensure a seamless integration so you could conduct business as you always have, without any effect on your accounts. We would need to convert PCFCU members to CFCU’s core processing system and account types, but this would not occur until October 1, 2021.

A: Part of the strategic vision is to optimize the board structure to have a balanced board representation of the membership and assets. It is the goal of the Boards to ensure that membership is well represented from all areas of the newly expanded field of membership. The skills, tenure, and expertise of all current board members are a great asset to the membership and the management team.

A: A new brand that progressively depicts the heritage and culture may be chosen and announced at a later date after a thorough review and vetting process. Both credit unions remain committed to our heritage of serving the financial needs of our communities. Immediately following the merger, The Penobscot County branches will continue to use the Penobscot County Federal Credit Union name, operating as a branch of The County Federal Credit Union. All other branches will use The County Federal Credit Union name.

A: We are here to answer all your questions! For answers to questions please call 1-877-318-3838.

Auto Loans

Auto Loans  Apply for a Loan

Apply for a Loan  Supervisory Committee Suggestion "Box"

Supervisory Committee Suggestion "Box"