The County Federal Credit Union was originally organized as Loring Federal Credit Union in 1956 to serve military and civilians that worked at Loring Air Force Base.

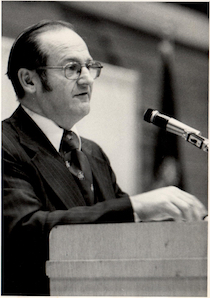

Joseph Bouchard Jr. was hired as the credit union’s first full-time manager in 1958. In 1964, Loring Federal Credit Union reached 2 million in assets, making it the state’s largest credit union. Holy Rosary Credit Union merged with Loring Federal Credit Union in 1969, making it the first Department of Defense credit union to expand into the local community. The following decades brought several other mergers with Loring Federal Credit Union: ACAP Federal Credit Union, Maine Sugar Industries Federal Credit Union, Limestone-Caswell Federal Credit Union, Presque Isle Federal Credit Union, Pamsong Federal Credit Union, MPG Federal Credit Union, Houlton Federal Credit Union, and Penobscot County Federal Credit Union.

Joseph Bouchard Jr. was hired as the credit union’s first full-time manager in 1958. In 1964, Loring Federal Credit Union reached 2 million in assets, making it the state’s largest credit union. Holy Rosary Credit Union merged with Loring Federal Credit Union in 1969, making it the first Department of Defense credit union to expand into the local community. The following decades brought several other mergers with Loring Federal Credit Union: ACAP Federal Credit Union, Maine Sugar Industries Federal Credit Union, Limestone-Caswell Federal Credit Union, Presque Isle Federal Credit Union, Pamsong Federal Credit Union, MPG Federal Credit Union, Houlton Federal Credit Union, and Penobscot County Federal Credit Union.

At the Front of Technology

In 1975, The County Federal Credit Union was one of the first credit unions to go online with The Maine Credit Union League’s data center. The County Federal Credit Union was also the first credit union to offer share draft accounts. Patrick St. Peter wrote the first share draft to clear the system.

A New Name

A name change to The County Federal Credit Union would occur in 1983 to better represent the communities the credit union was serving. In 1988, Joseph Bouchard Jr. retired and was replaced by Patrick St. Peter. In 1990, it was announced that Loring Air Force Base would be closed in 1994. Shortly after the announcement, the credit union moved its main office from Sawyer Road to Bennett Drive in Caribou. In 1993, a new branch office was opened in Fort Fairfield. In 2001, after 37 years of service, Patrick St. Peter retired.

On October 1, 2010, The County Federal Credit Union merged with Houlton Federal Credit Union. This merger expanded the existing field of membership to include all communities in Aroostook County south of Presque Isle. A new building at 247 North Street for our Houlton office opened on January 22, 2013. Later that year, iTalk was introduced, a new and improved telephone banking service, and soon after, County MoGO, The credit union’s mobile banking app, was made available.

After Kenneth Hensler’s retirement, Ryan Ellsworth was named President and CEO of The County Federal Credit Union in March of 2014. With a vision of growth, several developments were put into motion.

After Kenneth Hensler’s retirement, Ryan Ellsworth was named President and CEO of The County Federal Credit Union in March of 2014. With a vision of growth, several developments were put into motion.

In December 2014, Mobile Check Deposit was introduced.

In 2015, several new positions were being developed and planned because of continued growth. The positions were AVP of Marketing, Chief Financial Officer, and Retail Services Manager. Over the course of the next several months, all of these positions were filled as well as new office space to house the administrative team. In December of 2015, the Operations Center, a 7500 square foot building with 16 offices, was moved into 110 Carmichael Street in Presque Isle.

With ever-evolving banking developments, new debit cards with EMV technology, Apple Pay, Android Pay, Samsung Pay, and upgraded and updated online and mobile banking were introduced. In late 2017 a new checking product, the first in several years, was introduced to the public. The YES Account offers members all of the latest in technology with mobile banking and online banking. One unique feature is the Round-It-Up capability to round purchases to the nearest dollar and transfer the difference into the member’s savings account, allowing them to save money. At the same time, they spend and highlighting what credit unions were originally founded on, thrift.

On October 18, 2019, The County Federal Credit Union held its ceremonial groundbreaking for the new branch in Mars Hill. From Left to Right: Lori Michaud, Central Aroostook Chamber of Commerce, David Cyr, Mars Hill Town Manager; Jesse Chase, General Contractor, Buildings Etcetera; Shawn Anderson, Chairmen of the Board, The County Federal Credit Union; Ryan Ellsworth, President, and Chief Executive Officer, The County Federal Credit Union; John Folsom, Board Member, The County Federal Credit Union and Harry Smith, Equipment Operator for Soderberg Construction. The new 1200 square foot space featured the new branch concept with a Teller Pod, a Coffee/Technology Bar, and the only Drive-Up ATM in Mars Hill. It is a modern one-story, full-service facility in downtown Mars Hill located at the intersection of Route 1 and Route 1a, at One Benjamin Street in Mars Hill. “We endeavor to have our branches create amazing member experiences and to deliver what can’t be done through our other channels, we genuinely want a human connection to the credit union to drive our business into the future,” stated Ryan Ellsworth. The COVID-19 pandemic changed the timeline for construction completion and subsequent opening of the branch significantly. The first day the Mars Hill Branch opened for business was September 8, 2020. The First Day staff included: Dan Bagley, Executive Vice President; Kyle Taylor, Presque Isle Branch Manager; Cassie Lynds, Teller; Madelene Dickinson, Presque Isle Member Service Representative; Keara McCrum, Teller; Alaina Sweetser, Teller/MSR; Craig Lincoln, Branch Supervisor; Matthew Cox, IT Manager; and Janelle Morin, Mars Hill & Fort Fairfield Branch Manager.

Making of a Stronger Credit Union

In planning for the future, the boards of directors of The County FCU and Penobscot County FCU realized that a combined organization would bring much greater strength than each could provide on its own. The banking industry is always changing, and quite simply, the boards wanted to bring its members the best value from their credit unions and ensure that the credit unions continue to grow and thrive. The partnering of The County FCU and Penobscot County FCU provided the much-needed expansion in markets and products along with the financial strength to succeed.

Some History of Penobscot County Federal Credit Union

Penobscot Federal Credit Union was chartered on January 2, 1968, by NCUA for the employees of the Old Town Mill. The Credit Union added several other employee groups over the years and in 1987 the Board of Directors requested and was granted a community chartered expansion. In June of 2002, the Credit Union was approved for a further charter expansion to include all of Penobscot County. In order to more accurately reflect the larger field of membership but still keep its origin, the organization’s name was changed to Penobscot County Federal Credit Union. In June of 2003, the Credit Union was approved for a “low-income designation” from NCUA.

In an effort to provide our quality family-style services to a larger geographic area the Credit Union opened its first branch in Bangor, Maine in November 2002. A second branch opened in West Enfield, Maine in September of 2003 to better serve the members in Northern Penobscot County. In June 2016, Penobscot County Federal Credit Union finalized its’ merger with Howland-Enfield Federal Credit Union, in which the combined credit unions began operating as PCFCU. As a result of the merger, the Credit Union relocated the West Enfield branch to Howland. With dedicated support from the community, the Credit Union has grown into a full-service financial institution with over 10,000 members and assets over $88 million as of December 2020.

Today

In June of 2019, our Board of Directors and the Penobscot County Federal Credit Union Board of Directors voted to pursue a merger. After completing a field of membership expansion that included all of Aroostook, Penobscot, and Piscataquis Counties, members of PCFCU voted in favor of a merger on December 21, 2020. The merger was completed on January 1, 2021. At present, our membership has increased to over 30,000, with assets totaling over $450,000,000, ranking us in the top 7 largest credit unions in Maine (as of March 2024).

Auto Loans

Auto Loans  Apply for a Loan

Apply for a Loan  Supervisory Committee Suggestion "Box"

Supervisory Committee Suggestion "Box"